First of all, I would like to send all the forces to those who lost money due to the collapse of FTX. These must be very hard times for you and my humble recommendation is that you lean on your family and friends. Family and human relationships will always be more important than money.

A lot of strength and hopefully those responsible end up paying in justice.

It's Sunday afternoon and it's the craziest week end I've experienced since becoming interested in crypto back in 2018. There's no question that the collapse of one of the biggest exchanges, the now infamous FTX, took everyone by surprise.

It's just so cringe... FTX CEO Sam Bankman Fried was the person who used to lecture politicians in Washington D.C. on how to create inbound crypto regulation.

There is no doubt that what happened this week will hurt the crypto space for a long time, but at the same time it is an opportunity and a call for true crypto enthusiasts (those who are for decentralization and freedom) to take the initiative.

After thinking all week about how something like this can happen over and over again (it was actually really hard to focus on other things), I want to share some thoughts about this whole mess and more importantly how we can continue after this... but first a bit of context.

FTXs collapse in a nutshell

It is not the purpose of this post to deep dive into the details of the FTX collapse. In fact, you can do this by checking out tons of tweets, news, and articles that I'll be referring to. The very short version of the story is as follows.

- Sam was taking on self-appointed leadership to influence the upcoming crypto regulation. The crypto community was not in favor of his thoughts.

- Concerns arose Wednesday when Alameda's balance sheet was leaked. Alameda is a trading company owned by Sam Bankman Fried. Leaked balance shows that a significant portion of Alameda's value was based on the FTT token, centrally controlled and printed out of thin air by FTX.

WOW

— Dylan LeClair 🟠 (@DylanLeClair_) November 2, 2022

Per CoinDesk, Alameda research has $14.6 billion of assets, against $8b of liabilities.

For assets: $3.66b FTT, $2.16b “FTT collateral”, $3.37b crypto ($292m SOL, $863m “locked SOL”), $134m USD & $2b “equity securities.

Most net equity tied in completely illiquid altcoins.

- The CEO of Binance, the so-called CZ, liquidated Binance's position in FTT and since then, users started to withdrawal their assets.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

- FTX asks Binance for help to solve its liquidity crisis. Ultimately, Binance waived the potential buyout (LOI) and it became clear that FTX was insolvent, not illiquid.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

- Crypto market collapsed.

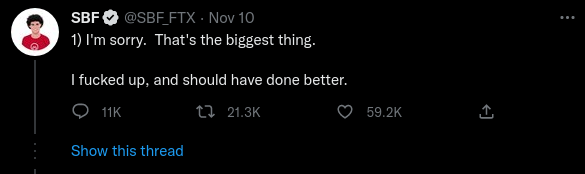

- It became clear that FTX seized customer deposits to bail out Alameda Research in the past. SBF took advantage of its position of trust to defraud depositors (although this will be determined by the courts, it seems pretty clear that this is what happened).

Trust me, the whole story is like a crazy movie and since a lot of the details aren't public yet, we have to go ahead and look at the big concepts.

This is the failure of centralized finances in crypto

The main purpose of blockchain is to remove financial intermediaries from our daily lives… but the natural development of the market gave centralized exchanges the same privileges as the greedy bankers who caused the 2008 crisis.

However, the outcome in the crypto space is even worse as it is unclear how consumer protection works and transparency standards have not been implemented. In short, bad practices of the traditional financial system were replicated, but with worse results.

There were trusted entities (exchanges, individuals, institutions) that abused their position for their own benefit.

What is most regrettable is that blockchain is about eliminating such practices through decentralization and technology.

In a sense it is disappointing, but this was always predictable and now we have no excuse to move towards more decentralization.

Regulations didn't prevent the fraud...

This is obvious, but remember that SBF used to frequent Washington to lobby for favorable regulation. It is clear to me that we need another approach to make crypto safe. We have to be honest, crypto is now full of greedy and bad people... unfortunately for every Vitalik, Satoshi or Erick Vorhees there are many SBF, Do Kwon, Alex Mashinsky, etc (just to name a few).

On this front, I think this is a good opportunity for the industry to adopt standards in favor of transparency, security and, most importantly, people.

What rules?... From here I will write some proposals in the next posts. The first ideas that come to mind are decentralized insurance (to reimburse users against hackers), proof of reserves and attestations, and finally measures that prevent fraudulent backdoors in smart contracts.

This is a call for backing to the principles

So at the end of the week, I cannot be too optimistic for the near future of cryptocurrencies. However, I am more optimistic than ever in the medium/long term. The greed of the middlemen and the collapse of FTX and everyone else going down in the next few weeks shows us how important it is to be diligent and studious... maybe it's a throwback to those good old crypto mantras the OGs tell newbies .

- Don't trust, verify... and that's exactly the reason for using those immutable, decentralized, distributed ledgers called blockchain.

- Not your keys, not your coins... and I'm so sorry to all the people who lost their life savings by entrusting their private keys to FTX. We have to repeat it over and over again: practicing self-custody is part of financial freedom.

- Less trust, more truth… and this is related to the first point, but here I want to point out the importance of giving DeFi a chance. From regulators to retail investors, there are big projects like AAVE or THORCHAIN (among many others)... but there is also a lot to build... an example I'm working on? crypto payments with on-chain swaps, so you can pay with your BTC or ETH and the receiver can choose which currency they want to receive their payment (USDC, DAI, BTC, etc.).

So what is next?

In the short term, it is time to resist and fight for the very principles of crypto. It's time for developers to build, researchers to come up with exciting new ideas, and investors to educate themselves and avoid get-rich-quick schemes.

For me, at least, it is clear that I will work harder to create technology for good. I still believe in blockchain and the impact we can have... this is only possible if we stay restless and open to the new.

Finally... stay safe and stay crypto.