Latin America is a magical part of the world. Its nature is amazing, its towns and cities are vibrant and colorful, its reserves of natural resources are vast, and its people is charming and have the talent to change the world. However, many Latin American countries are facing a deep social and economic crisis, mainly stemming from the pandemic and embedded corruption at all levels.

This forces people to look for alternatives and crypto is one of the first and most logical answers. In fact, despite the brutal bear market we are experiencing, the adoption of cryptocurrencies is booming in the region. All of the above represents a unique opportunity for the nascent crypto ecosystem in Latin America.

This is a special blog, in part because I know that in the future we will see this moment as a fundamental period for the development of Latin America, and I want to be part of that positive change. So, in this post, we will examine the path that Latin America must take to reach mass adoption of crypto. We will also explore the challenges to benefit from the full potential of blockchain technology. If you like Latin America and cryptocurrencies, this is a blog that you will not want to miss.

This is just my opinion. This is not financial advice. Remember the sacred words "DYOR" (Do your own research).

Latin america wants crypto

On June 8, 2021, El Salvador passed the Bitcoin Law, which gave BTC legal tender status from September 7, 2021. One might be tempted to think that the adoption of cryptocurrencies is just beginning in Latin America, but this is not the case. Latin Americans have a long history of accepting cryptocurrencies mainly out of necessity and not just speculation.

Perhaps the first real-world use case for cryptocurrencies was remittances. Many Latin American workers, mainly in the US, relied on expensive and traditional remittance services to send money to their families in their home countries (mainly in El Salvador, Honduras and Costa Rica). In this context, cryptocurrencies offered a viable and more convenient alternative in the early days of crypto. Of course, crypto adoption in Latin America is much more than just remittances. In fact, according to the "geography of crypto report" by Chainalysis, many Latin Americans are using crypto in P2P platforms.

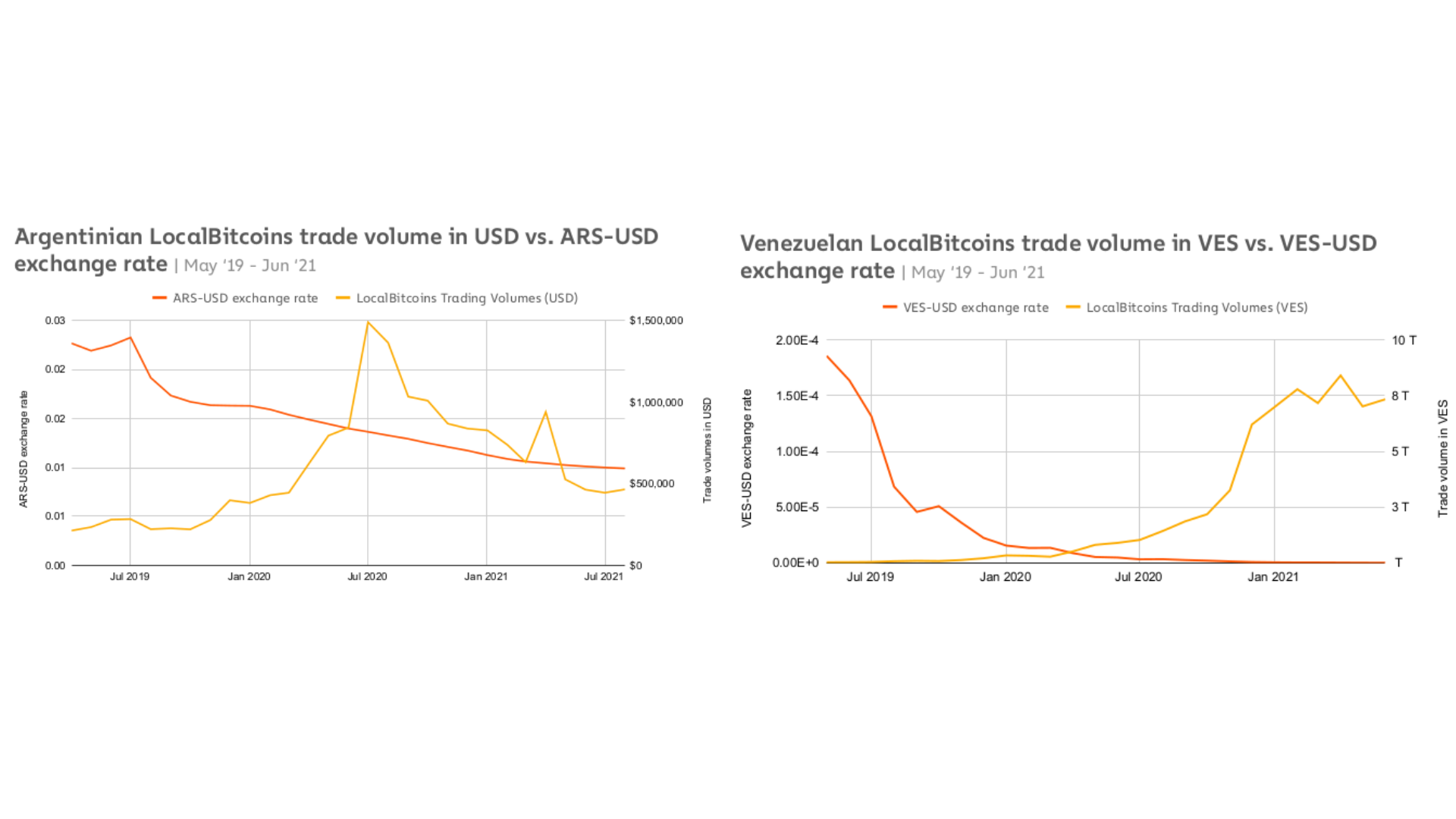

Last but not least, BTC is widely used as an attractive store of value against the rapid devaluation of FIAT national currencies in LatAm. In fact, we can see how the price of BTC is closely related to the devaluation of the national currencies in Argentina and Venezuela.

So the good news is that Latin Americans want to use cryptocurrencies. That is why I think that we are facing a great opportunity to show the real potential of decentralization.

Towards the use of cryptocurrencies in our daily lives

The next step to mass adoption is using crypto for more convenient payments. In other words, cryptocurrencies and blockchain must have a real daily-life utility.

A great example of this are the traditional Points of Sales (POS) (these typical devices to pay with debit or credit cards in stores). Traditional POS are not convenient for merchants because they are extremely slow (the money takes 1-2 days to reach its destination) and expensive (up to 4% approximately in commissions in Chile). Here, crypto is an excellent alternative, because it is cheaper, faster and more secure. There are currently several ways to accept crypto in stores, for example with the Bitcoin Lightning Network, Solana Pay and Near Pay (perhaps among others, but this is what I know and use).

So, with this example, I wanted to illustrate how cryptocurrencies can be adopted in our daily lives (with crypto POS or crypto salaries for example, why not?). However, there is a caveat: it is important to maintain self-custody (with non-custodial wallets) to deliver ownership of the money to whom it belongs and avoid the possibility of being affected by liquidity problems that companies may have. If there's one thing 2022 has taught us in crypto, it's "NOT YOUR KEYS, NOR YOUR COINS."

Major challenges

Of course, all of the above sounds incredible, but we are still far from mass adoption. In fact, there are great challenges and threats to crypto technologies in LatAm. We will examine them below.

- Collaboration spaces are lacking and this is true not only for cryptocurrencies, but for technology in general. I know there are actually some in LatAm, but they are not enough. Crypto entrepreneurs and experts need bigger networks in LatAm, but also in other regions. In fact, we need connection points with more developed ecosystems such as Switzerland, Singapore, the United States, among others. By having these networks we can benefit from their know-how so as not to start from scratch.

- Mass adoption will not be a reality without education. This is a massive effort that needs to come from experts, enthusiasts, and companies. I want to be clear: we need a lot more financial education in LatAm (and everywhere). We must also provide simpler but more complete explanations about the benefits and risks of using cryptocurrencies… with full transparency and humility.

- We need more real-world use cases for crypto. It is 2022 and it is the perfect time to build use cases for the people, and not just for the corporate/financial sector. I just want to emphasize the tremendous importance of decentralization in technology and society. Decentralization is a tool for freedom, for justice, and for the construction of a better world.

Final thoughts

After this blog, we can see why crypto is booming in LatAm. Its unique properties empower people and empowered people can build better societies, but the opposite is also true. The truth is that there is still much work to be done. However, I am hopeful, because it is time for cryptocurrencies to show their true potential.

It's clear to me, it's time to FOCUS ON THOSE WHO NEED MOST.