A deep dive into the fundamentals of future money

We are in 2022, in the middle of the perfect storm. Inflation is peaking, interest rates are rising to the point that a recession seems inevitable, the global supply chain is damaged and stagnant due to the COVID pandemic (yes, we are still in a pandemic), and the Russian invasion of Ukraine is putting the world on the brink of a major food crisis.

As if this were not enough, we are facing a bear market in stocks, cryptocurrencies and almost everything. It seems that something in our monetary system is fundamentally broken and we are living through what Mohamed El-Erian describes as the "everything bubble".

In this context, it is worth asking why our money and savings are constantly losing value. Why do we have to listen to the words of one man at the FED? (Yes, that man who raises interest rates, the same one who said that inflation was transitory). Are we at the beginning of a new great economic change? And last but not least, do I have to save my money in FIAT currencies (such as USD, EUR or CHF), in GOLD, or is there a better alternative?

This blog is about the future of money. Because in this time of uncertainty, we just know that things are going to change A LOT. I will try to answer why (or why not) Bitcoin will be the preferred future money to the detriment of GOLD and FIAT. I will try to expose all the pros and cons beyond the FOMO and FUD. I will also point out the breakthroughs we need before this change can be made.

This is not financial advice, it is just educational content and my personal opinion. Remember the holy words "DYOR" (Do Your Own Research).

FIAT currencies will inevitably fail

First, I'll show you why FIAT currencies are a bad form of money. But let's start from the beginning... FIAT currencies are "normal money" like USD, EUR or CHF that are created by central banks. The term FIAT comes from Latin and means "let it be done", so the power of FIAT currencies is based on the power of the state. We basically use FIAT currencies because we are obligated by the state and they have a monopoly on violence.

So the first point is that FIAT money is inherently against the free market. In fact, we live in a capitalist society where we love the benefits of the free market, but the most important good (money) is controlled by a central entity (what a score for Karl Marx and his gang!). So FIAT monetary system gives politicians immense power, and power corrupts. As a result, we have our close companion “inflation” which is an unlegislated tax that hits the poor much harder.

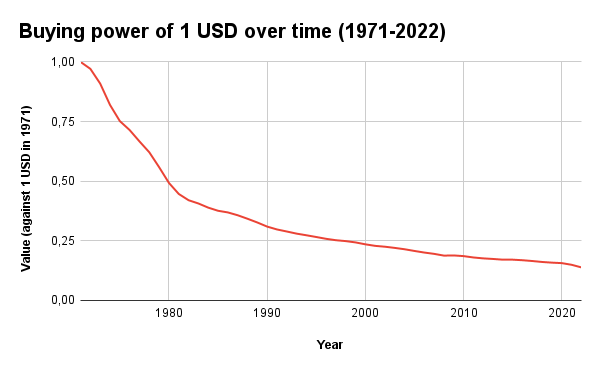

Inflation in turn is generated by an increase in the supply of money in circulation. This FIAT money can be created out of thin air and that makes it a very bad store of value. In fact, the dollar USD, that is the most successful currency in the world, has lost 86% of its purchasing power since 1971 (the year the USD was no longer backed by gold).

Finally, FIAT currencies are an experiment that has always failed. No matter the time or the country or empire. From the Roman denarii to the US dollar, all FIAT currencies are destined to fail in the medium term. In fact, FIAT currencies have historically recorded an average life span between 27 to 35 years and our monetary system now is 51 years old so we could be in the brink of a big change.

The key properties of Bitcoin

Ok, now we know that FIAT money will fail, but is there a chance that Bitcoin will replace FIAT in the future?, What are the properties that make BTC good money?

- Bitcoin is mathematically scarce and there will only be 21 million BTC. This is good because its limited supply makes it an apolitical money.

- Bitcoin is durable and easy to transfer. You just need the recipient's address which can be a QR code or now even a cool .crypto domain linked to your real address to transfer the money.

- Bitcoin is fungible and divisible, so your BTCs (or SATs) are the same as those in Satoshi Nakamoto's wallet. But to be completely transparent, this is debatable because due to the transparency in the Bitcoin blockchain, there are some "blacklisted" BTC that would not be accepted by exchanges or individuals (BTC belonging to illicit activities, for example) .

- Bitcoin is transparent, but not anonymous. There are companies that can track BTC transactions and can guess who owns this asset (Chainalysis is a company that does this).

- Bitcoin is censorship resistant. Due to its decentralized design, no one can stop a BTC transaction.

- Bitcoin is decentralized by design. One of the most valuable features of Bitcoin is its network made up of thousands of miners who verify transactions. They are distributed all over the world and make Bitcoin the most secure network on the planet (with an operational uptime of 99.985%).

So these properties make BTC a good candidate to be the money of the future.

BTC is like GOLD, but better

Now it's time to analyze how BTC with its properties is like GOLD but better. GOLD has all the properties of good money. In fact, GOLD is in limited supply (we'll discuss that in a bit), it is durable, divisible, portable (not that much, but still), and widely accepted as a means of payment. GOLD also has the advantage of the test of time, as GOLD has been the monetary standard for millennia, while BTC has been with us for less than 15 years. However, let me emphasize some advantages of BTC over GOLD as a store of value.

First, BTC has a limited supply of 21 million coins, while GOLD's supply may increase in the near future. In fact, when we discover other planets and asteroids, they may be full of GOLD and other rare minerals. GOLD is likely to lose its scarcity forever. This brings us to one of the most controversial ideas on this blog: "the stores of value of the future will not be physical commodities".

GOLD will not be a store of value when we travel to other planets and asteroid mining becomes a reality.

Second, GOLD transactions and storage are expensive, time consuming, insecure and highly inefficient. Instead, BTC can be easily transferred from one wallet to another and its storage is practically free (assuming self-custody).

All of the above does not invalidate GOLD as good money, but it does make BTC a better option.

Bitcoin will win, but not now

Great!... now we look like Bitcoin maxis, but not so fast!...

Bitcoin exhibits great potential but it is still in its early stages and there is a lot of work to be done, there are some limitations and some drawbacks that we need to talk about. I will list some of them (for the sake of blog continuity)

- Bitcoin and its technology is advanced and very difficult for non-tech savvy people to understand. We need to make Bitcoin easier to understand, and for that we need education, much more education.

- Bitcoin must move from speculative demand to real world applications and to do this we need to work harder. I acknowledge the immense effort of developers and entrepreneurs, but this is a call for more people to come together and create new real-world use cases for Bitcoin. We need this A LOT.

- We need alternatives to recover our private keys if we lose them. I know that having ownership of something comes with responsibility, but to achieve mass adoption we need a solution. Here I don't have an answer, but if there is anyone who has an idea please contact me.

That said, BTC has tremendous potential to replace government FIAT currencies in the future. If it happens, it will be wonderful, because the adoption of BTC will happen with the force of freedom.

Final thoughts

This was a blog where I literally wrote with passion. I am sure that BTC will play a crucial role in the future. Through my research, I confirmed that the fundamentals of Bitcoin are solid and now I feel very committed to spreading it around the world. Also, I recognize that there is still a lot of work to be done, but the most important is education. We need more financial education for people, we need to raise awareness about privacy, true ownership, non-censorship and freedom.

If you enjoyed reading the content and found my work useful, please share this blog with your friends... and see you next time!

The future will be crypto!